Annual Budgeting Planner Template for Google Spreadsheets

Plan your finances for the entire year with monthly breakdowns. Set income and expense targets, track actual spending against your budget, and get alerts when you're off track. See your yearly financial progress at a glance.

One-time purchase • 14-day money back guarantee

Ready-to-use Spreadsheet Template

What You'll Know About Your Year

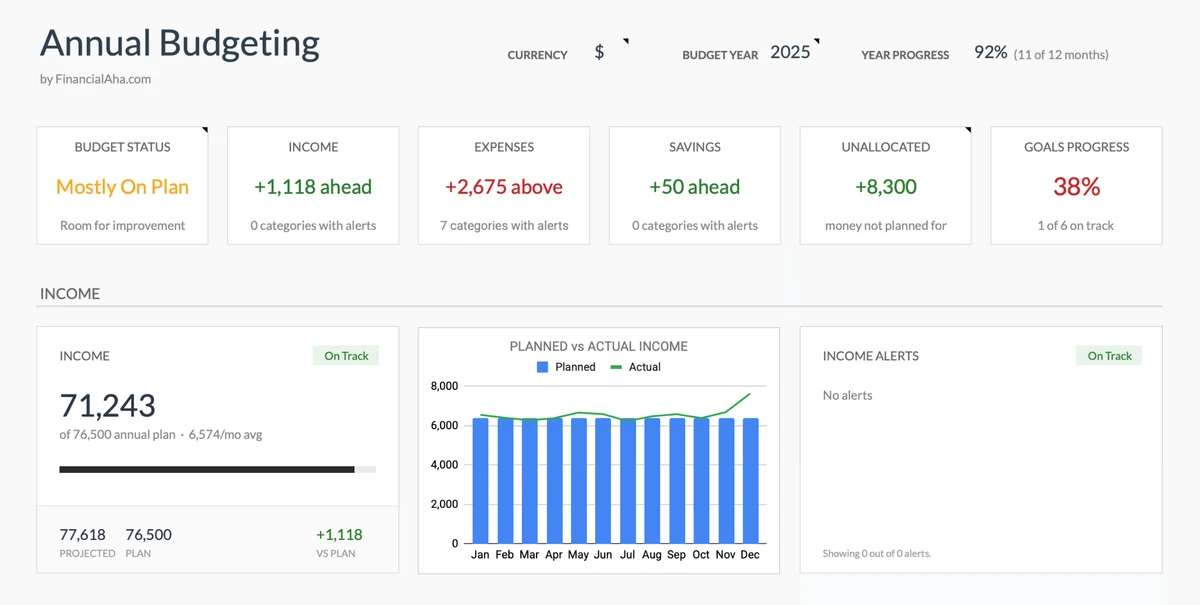

Know If Your Year Is On Track

See your budget status, income vs plan, and savings progress - all in one view. Know instantly if you're ahead, behind, or right on track. No more waiting until December to find out.

- Budget status at a glance

- Year progress tracking

- Planned vs actual comparison

See Where Every Dollar Goes

Spot which months you're saving, which months you're overspending, and why. Visual breakdowns show exactly where money flows - so you can course-correct before small leaks become big problems.

- Monthly surplus/deficit trends

- Income breakdown by source

- Expense & savings distribution

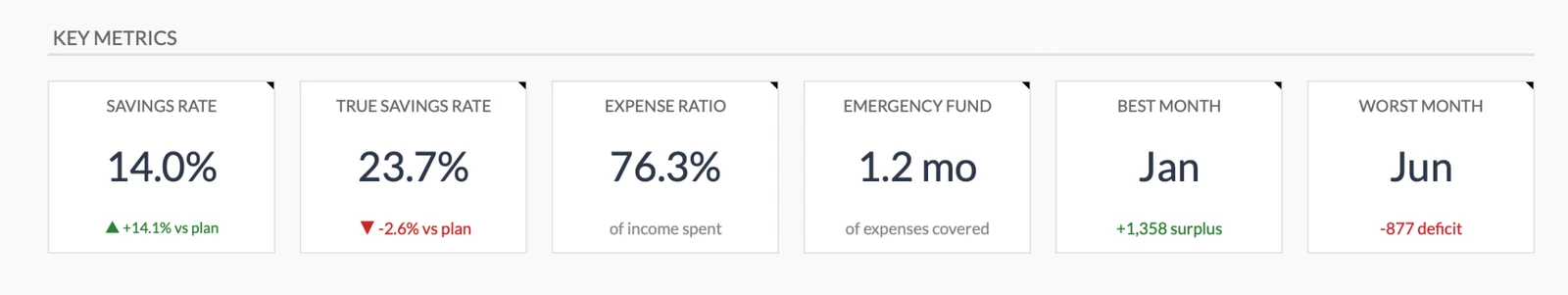

Measure What Actually Matters

Know your savings rate, expense ratio, and emergency fund coverage at any point in the year. Instantly identify your best and worst performing months - and learn from both.

- Savings rate vs plan

- Emergency fund coverage

- Best & worst month analysis

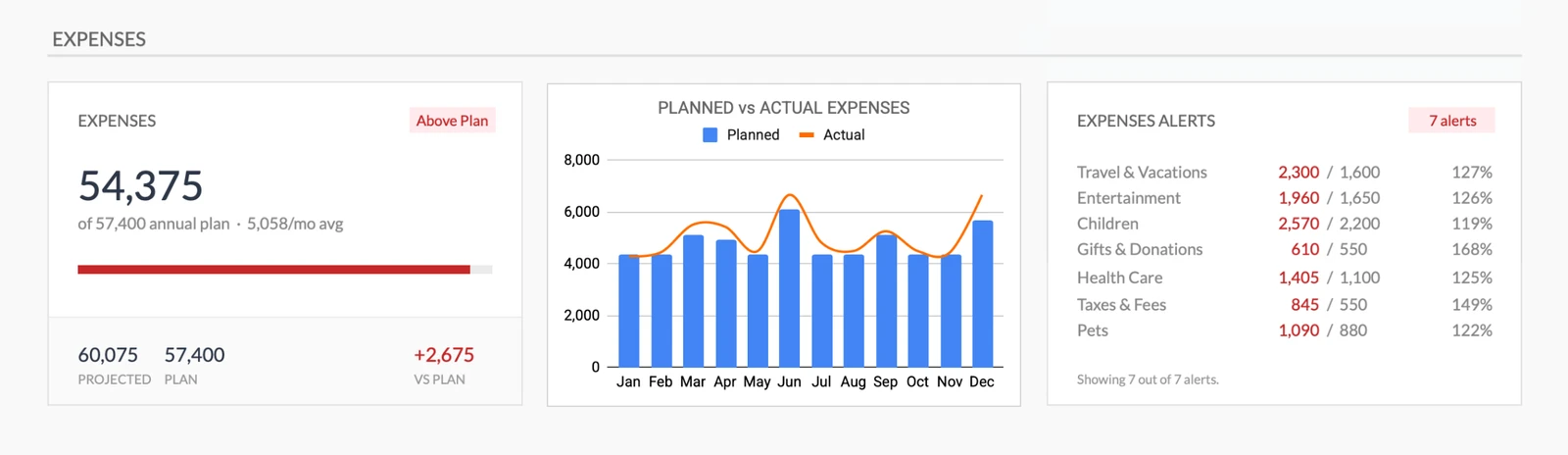

Catch Overspending Before It Hurts

The template automatically flags categories exceeding their budget - showing you exactly how much you're over and by what percentage. Fix small problems before they become big ones.

- Automatic category alerts

- Percentage over budget

- Planned vs actual expenses

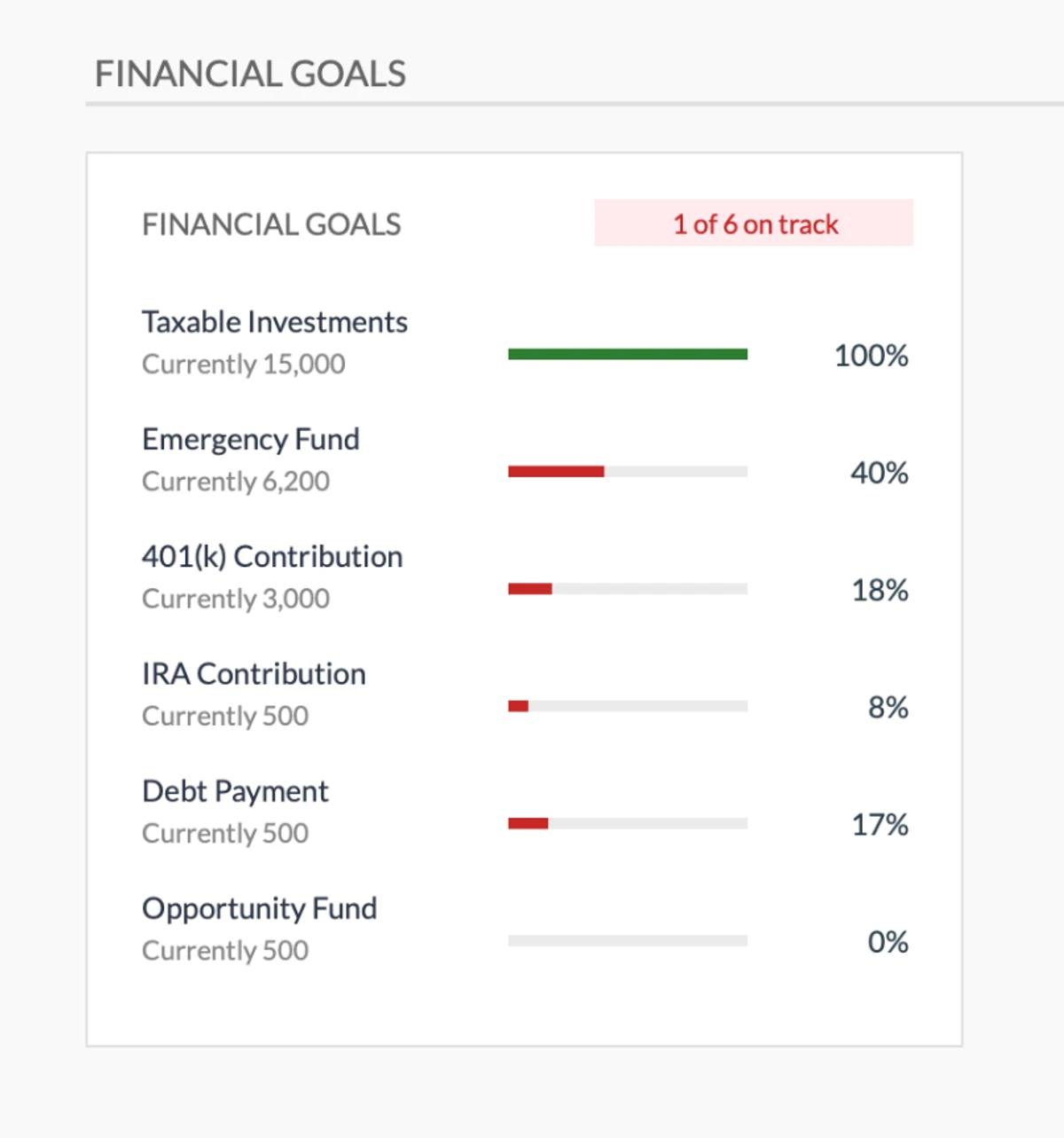

Watch Your Goals Get Closer

Set financial goals and see your progress throughout the year. Whether it's retirement contributions, emergency fund building, or debt payoff - visual progress bars show how far you've come.

- Unlimited goals

- Visual progress bars

- Goals completion tracking

Start Planning Today - Not Next Week

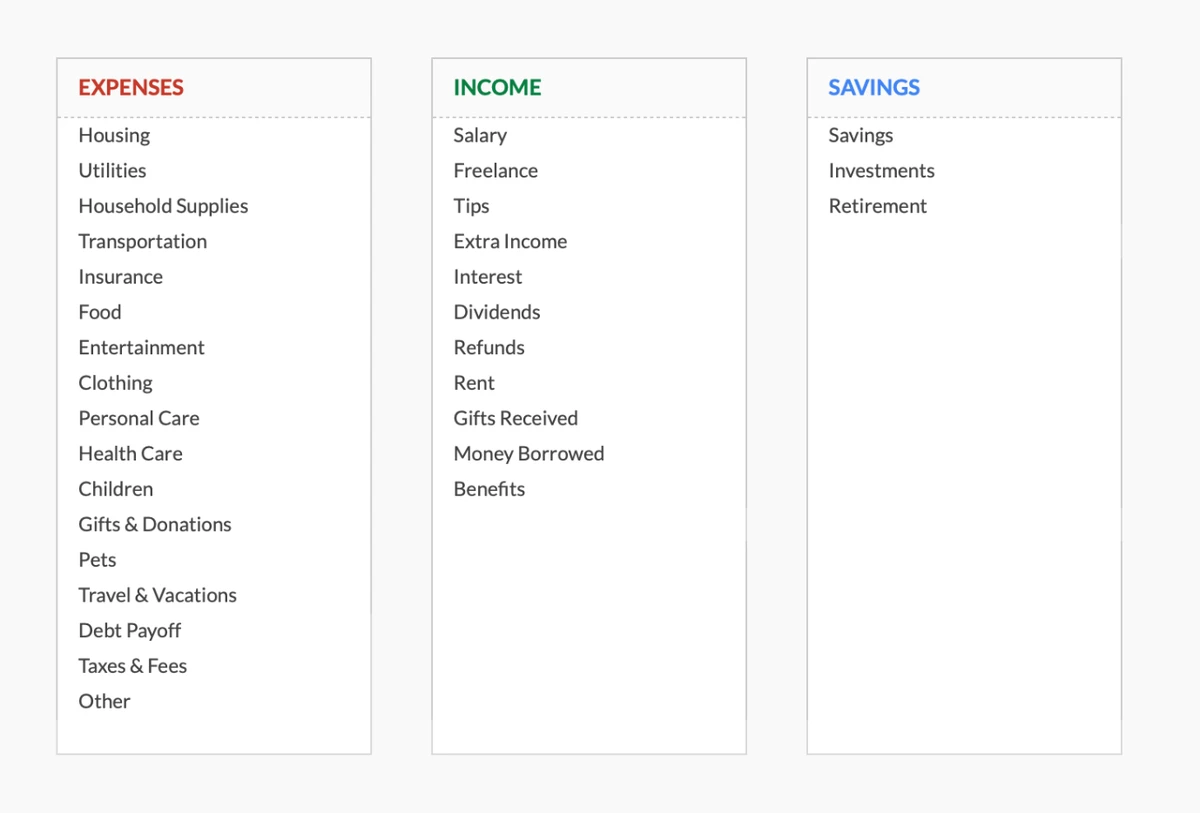

Pre-built categories for expenses, income, and savings mean you can start immediately. No setup required - just open and begin. Customize later if you want, or use it as-is.

- Expense categories ready

- Income sources included

- Savings tracking built-in

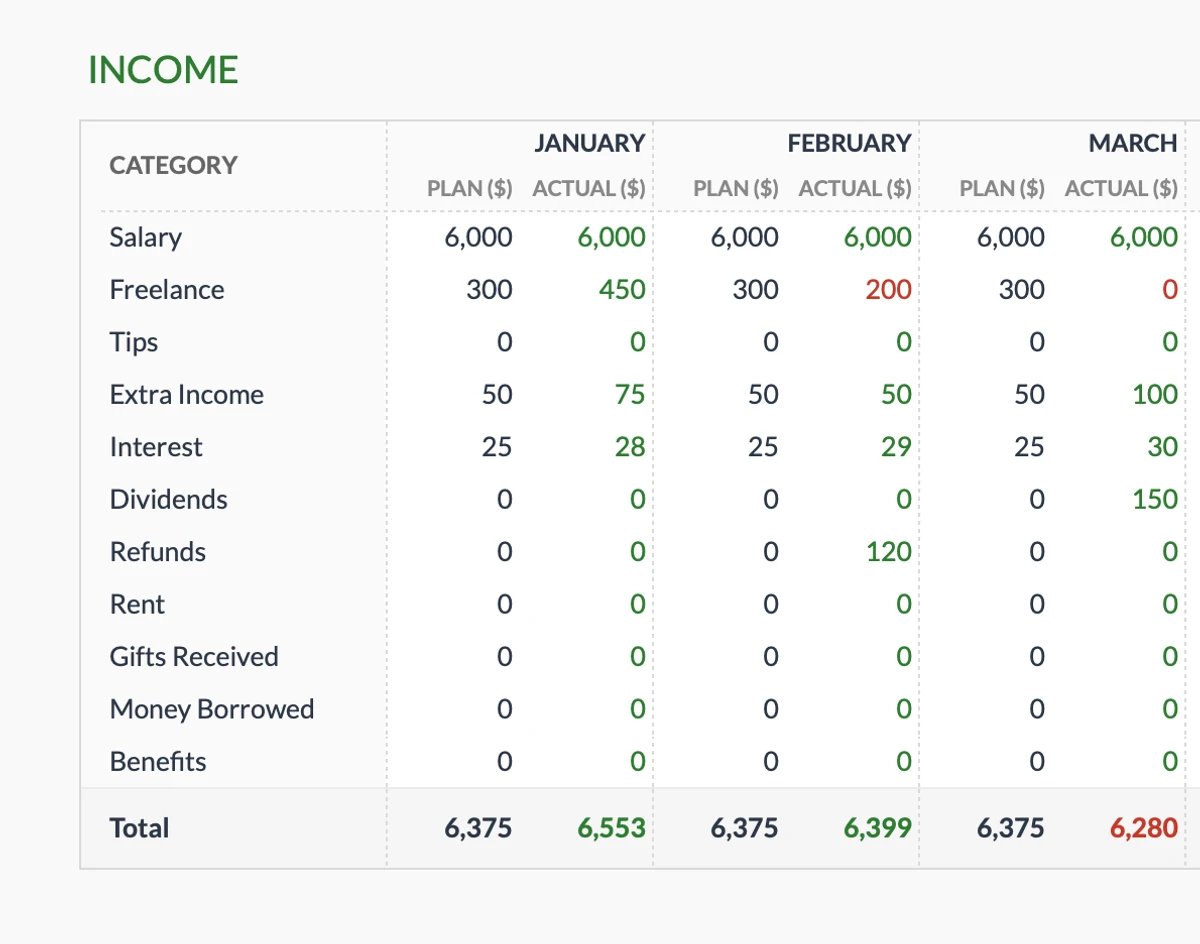

Monthly Income Planning

Plan your expected income for each month and track actual earnings as they come in. See variances instantly with color-coded indicators showing whether you're ahead or behind your income goals.

- 12-month income plan

- Planned vs actual tracking

- Color-coded variances

Monthly Expense Management

Set monthly expense budgets for all categories and track actual spending. Instantly see which categories are on track and which need attention with automatic color coding.

- Category budgets

- Monthly planned vs actual

- Automatic variance alerts

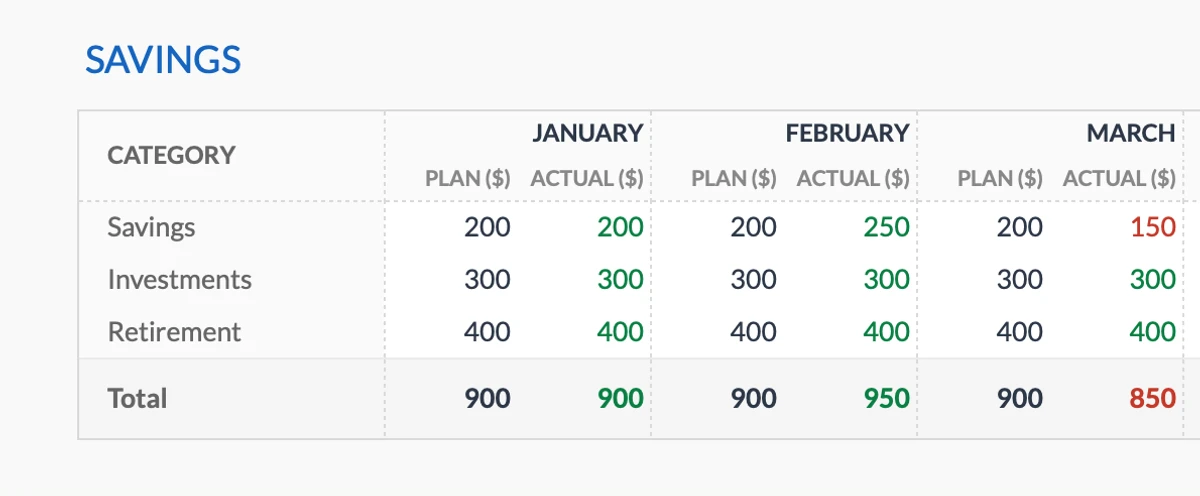

Monthly Savings Goals

Plan your savings contributions for retirement, investments, and general savings each month. Track whether you're hitting your targets and building wealth according to plan.

- Savings categories

- Monthly contribution tracking

- Year-to-date totals

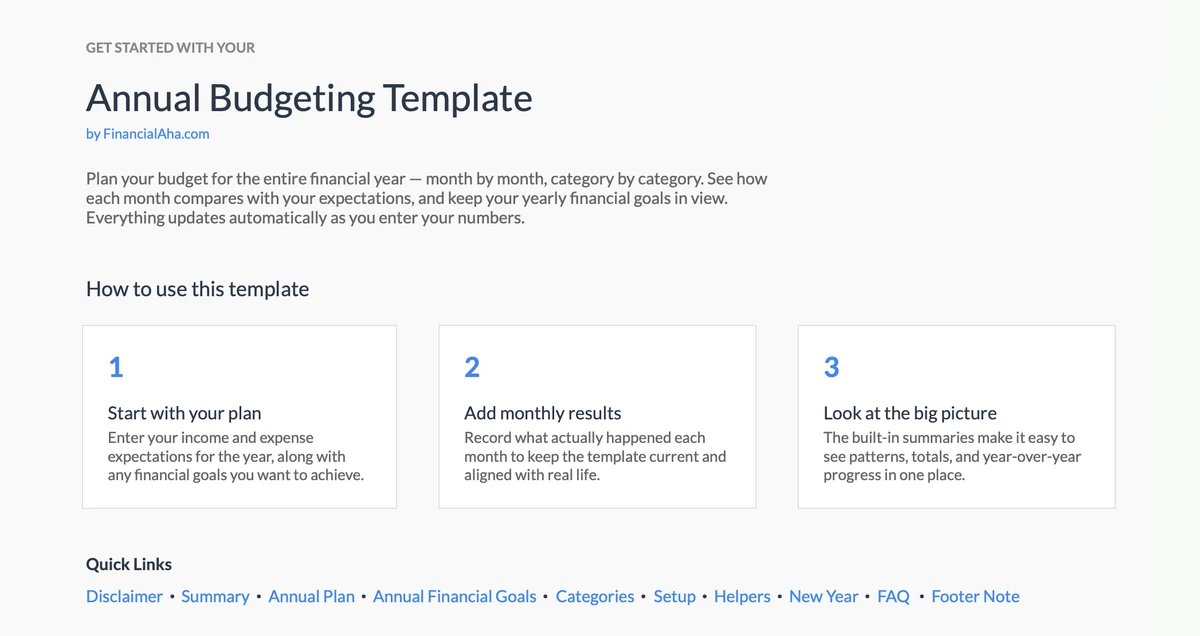

Step-by-Step Instructions Included

Never wonder what to do next. Detailed guidance walks you through setup, monthly entries, and year-end reviews - even if you've never budgeted annually before.

- Detailed how-to guide

- Quick navigation links

- Monthly review workflow

Customizable & Flexible

Fully customizable to match your financial situation. Add categories, modify goals, and adapt the template to your unique needs.

- Add custom categories

- Modify financial goals

- Adapt to any income structure

Ready to take control of your finances?

Simple 4-Step Process

How It Works

Download & Setup

Get instant access via Google Sheets. Set your annual income plan and budget targets for each category.

Enter Monthly Data

Each month, input your actual income, expenses, and savings. The template handles all calculations automatically.

Monitor Progress

Watch your dashboard update in real-time. See alerts for overspending and track goal progress throughout the year.

Achieve Your Goals

Use insights from key metrics and trends to make informed decisions and hit your annual financial targets.

Customer Reviews

What Our Customers Say

"If I get half as good at handling my finances as you are at customer service, this'll be the best $26 I've spent lately."

"Great tool! Simplifies financial planning without the hassle of complex spreadsheets."

"I recently purchased your super convenient spreadsheet, it really helps me!"

"They're great and super intuitive. Thank you!"

Built for Results

Why This Template Works

Complete Year View

Plan and track all 12 months in a single, organized spreadsheet.

Easy to Use

Pre-built formulas. Just enter your numbers and watch the magic happen.

Google Sheets Based

Access from any device, anywhere. Your data syncs automatically.

Free Updates

All future improvements and features included at no extra cost.

100% Private

Your financial data stays on your Google account. We never see it.

Lifetime Access

One-time purchase. Use it year after year, forever.

Got Questions?

Frequently Asked Questions

Is this template free to use?

This template is not free, but it is available for a one-time purchase. This purchase gives you lifetime access to the template and all future updates.

What do you mean by lifetime access?

Lifetime access means that you will have access to this template for as long as you need it. You will not be required to pay any additional fees for continued access to the template or any future updates.

Do I need to sign up to use this template?

You don't need to create an account with us. The template works in Google Sheets, so you'll need a Google account. If you don't have one, you can create one for free at google.com. After you purchase the template, copy it to your Google Drive, and start using.

What are the benefits of using this template?

This template offers a range of benefits, including: Easy-to-use interface, Customizable to suit your needs, Secure and private, Regular updates and improvements, One-time purchase for lifetime access.

Can I get future updates?

Yes, you will receive all future updates to this template at no additional cost. This ensures that you always have access to the latest features and improvements.

Do you offer any discounts?

At this time, we do not offer any discounts on this template. However, the template is available for a one-time purchase, which provides lifetime access and free updates.

Do you have any access to my financial data?

No, we do not have access to your financial data when you use this template. The template is designed to be used in your own Google Sheets account, ensuring that your financial information remains private and secure.

Is this template financial advice?

Our templates are not financial advice. They are tools designed to help you manage your personal finances more effectively. If you need personalized financial advice, consider consulting with a financial advisor or accountant.

Can I make my own changes and customize this template?

Yes, you can make your own changes and customize this template to suit your needs. The template is designed to be flexible and adaptable, allowing you to add or remove sections, change formulas, and adjust formatting as needed.

Do you offer technical support?

This is a self-service product, and we do not offer technical support. However, if you encounter any issues or have any questions about the template, please contact our team for assistance. Because everyone's financial situation is unique, consider consulting with a financial advisor or accountant if you need personalized financial advice.

Do you offer refunds?

Yes. We offer a 14-day money back guarantee on all paid products. If you're not satisfied for any reason, contact us within 14 days of purchase for a full refund.

Can't find the answer you're looking for? Contact our team

Highlights:

Ready to Take Control of Your Annual Budget?

Get instant access to the Annual Budgeting Planner and start planning your entire year's finances today.