Retirement Financial Planning & Projections Template for Google Spreadsheets

See exactly when you can retire and how long your money will last. Enter your savings, expected expenses, and pension income - the template calculates your retirement timeline across three scenarios and stress tests your plan with 12 what-if scenarios.

One-time purchase • 14-day money back guarantee

Ready-to-use Spreadsheet Template

What You'll Know About Your Retirement

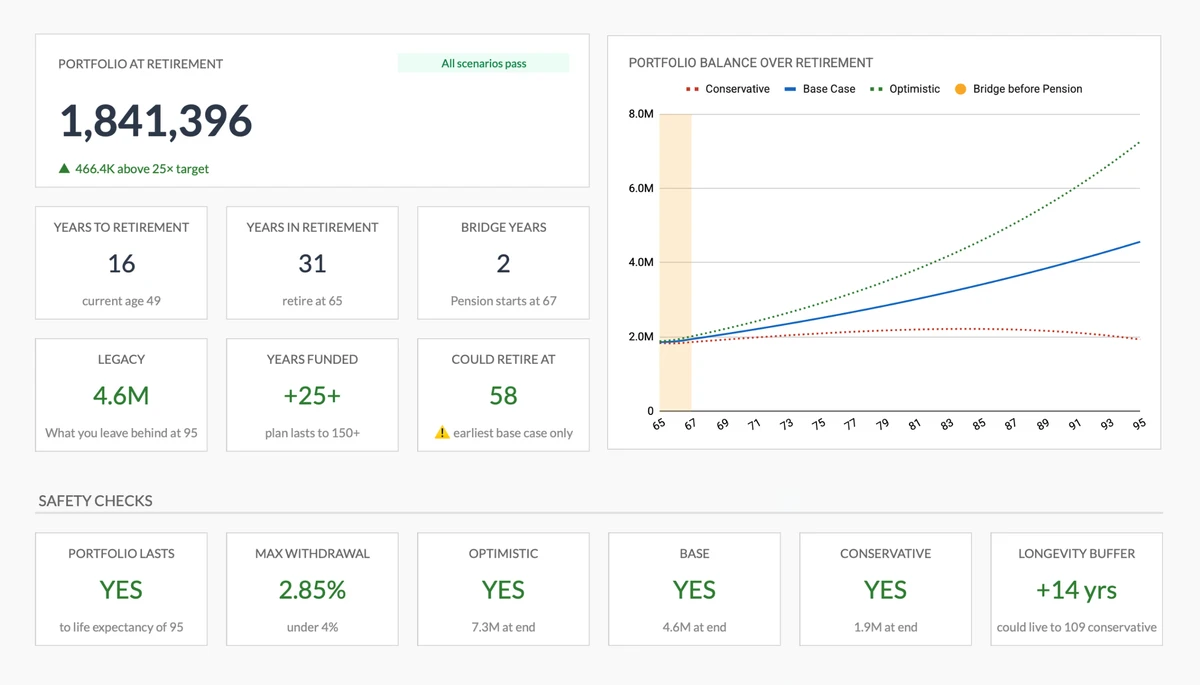

Your Complete Retirement Picture at a Glance

See your projected portfolio value at retirement, years until you stop working, and how long your money will last. Built-in safety checks tell you if your plan is on track.

- Portfolio value at retirement

- Years to retirement countdown

- Safety checks for your plan

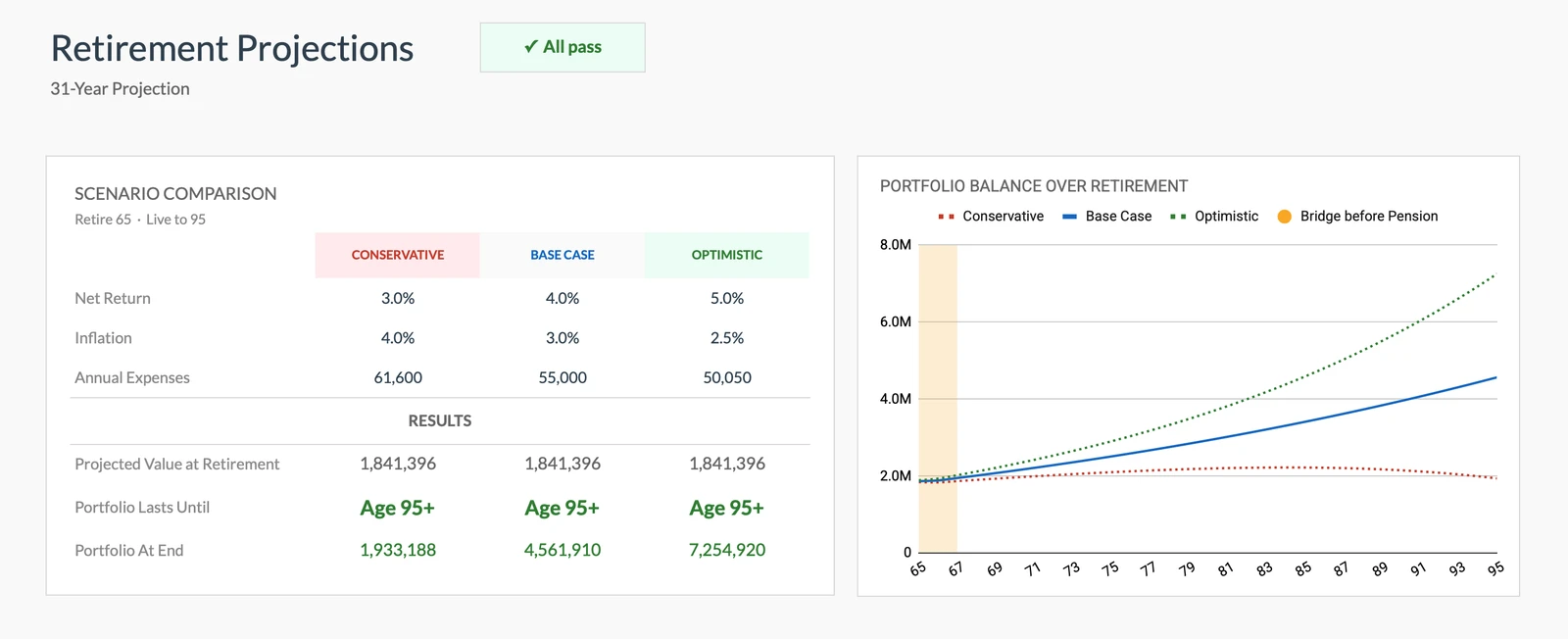

Compare Conservative, Base, and Optimistic Outcomes

See how different market conditions affect your retirement. Compare three scenarios side by side - conservative, base case, and optimistic - so you know what to expect in good times and bad.

- Three scenario comparison

- Portfolio balance projections

- Visual charts over time

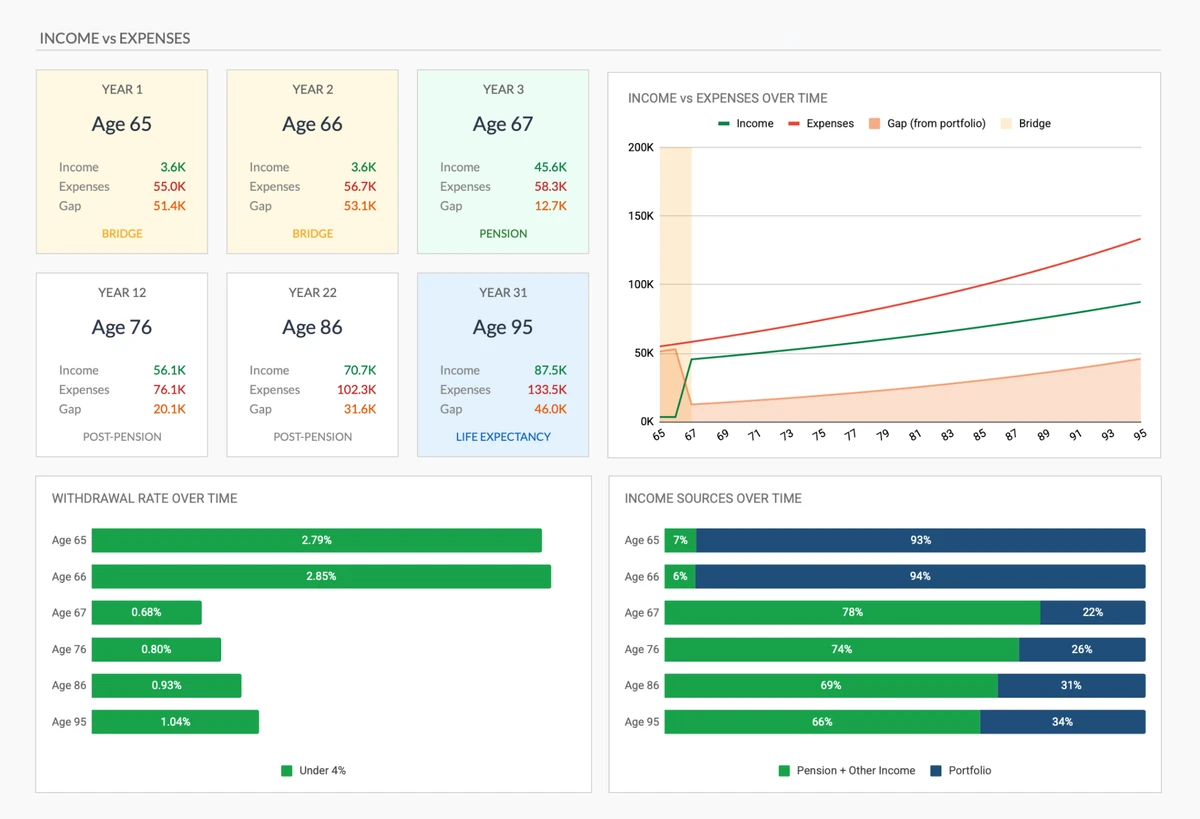

Track Your Money Throughout Retirement

See how your income and expenses change in 5-year intervals through retirement. Track when pension kicks in, how much comes from your portfolio, and whether you're on pace.

- 5-year breakdown

- Withdrawal rate tracking

- Income source visualization

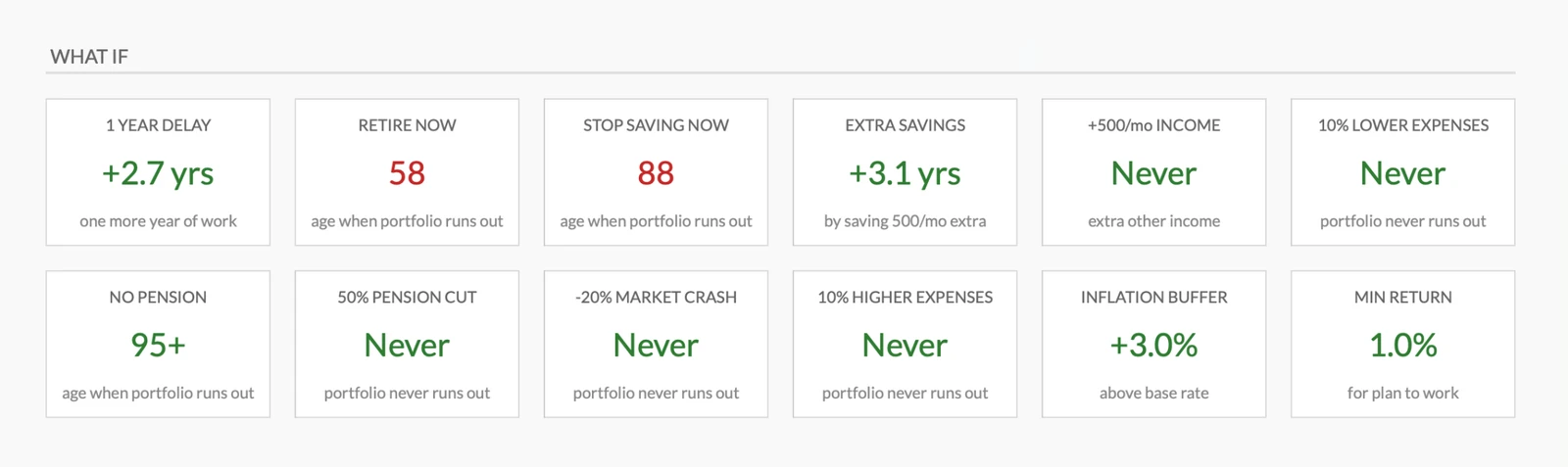

Stress Test Your Retirement Plan

See how changes affect your plan. What if you retire a year early? Save more? Spend less? Face a market crash? Twelve scenarios show the impact of different decisions.

- 12 what-if scenarios

- Retirement timing impact

- Market crash resilience

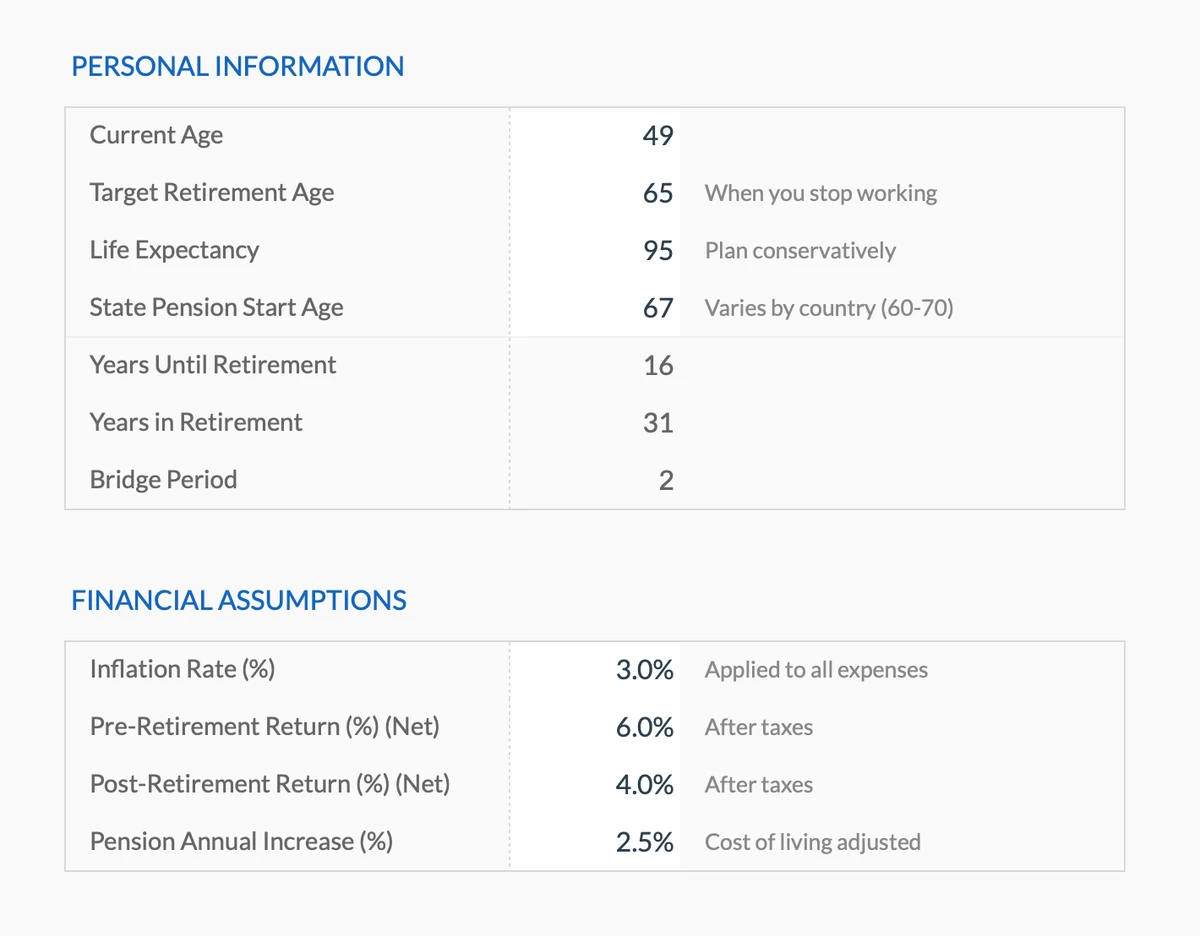

Start With Your Personal Details

Enter your current age, target retirement age, and life expectancy. Set your financial assumptions - inflation rate, expected returns before and after retirement, and pension adjustments.

- Age and timeline inputs

- Financial assumptions

- Pension timing settings

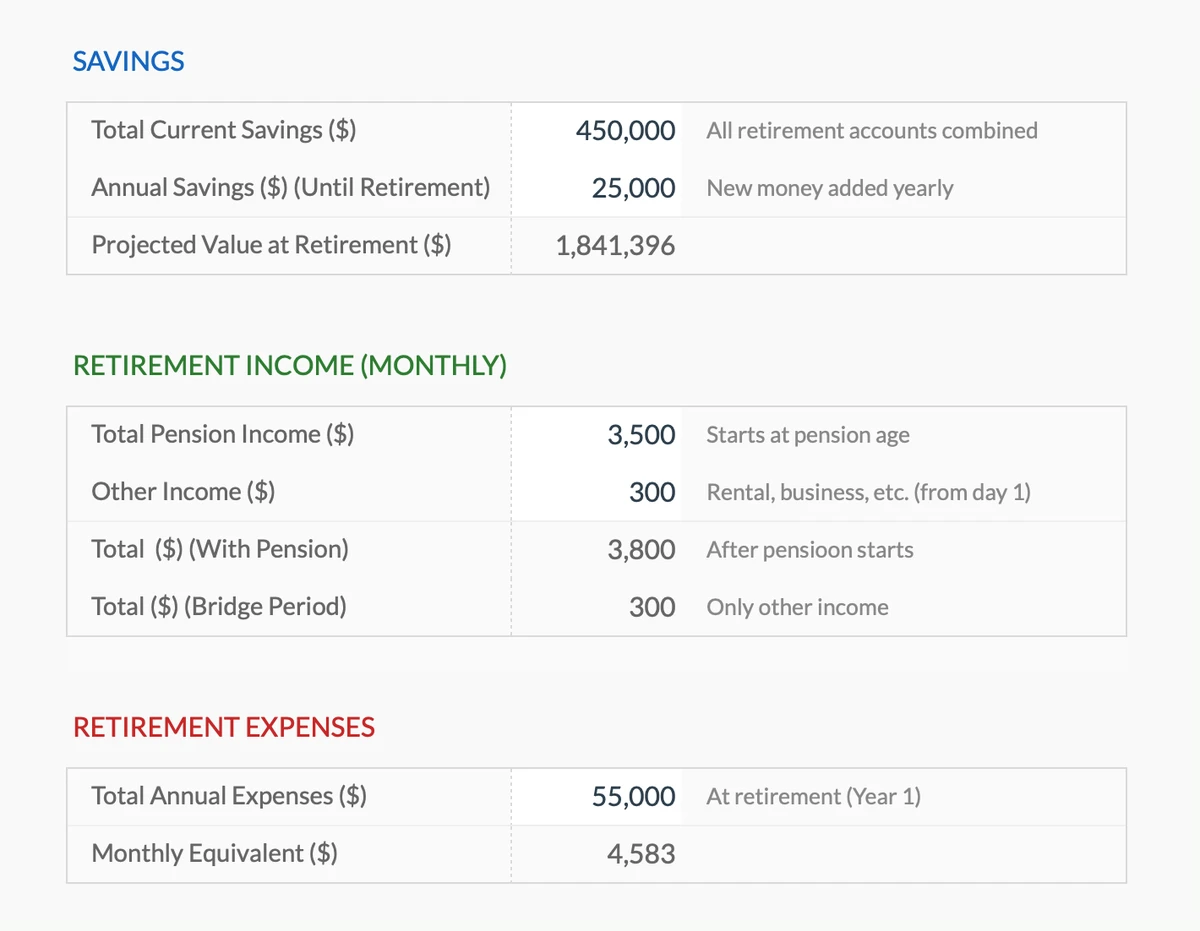

Enter Your Money Numbers

Input your current savings, how much you add yearly, expected pension income, and retirement expenses. The template uses these to calculate everything else.

- Current savings total

- Annual contributions

- Expected expenses

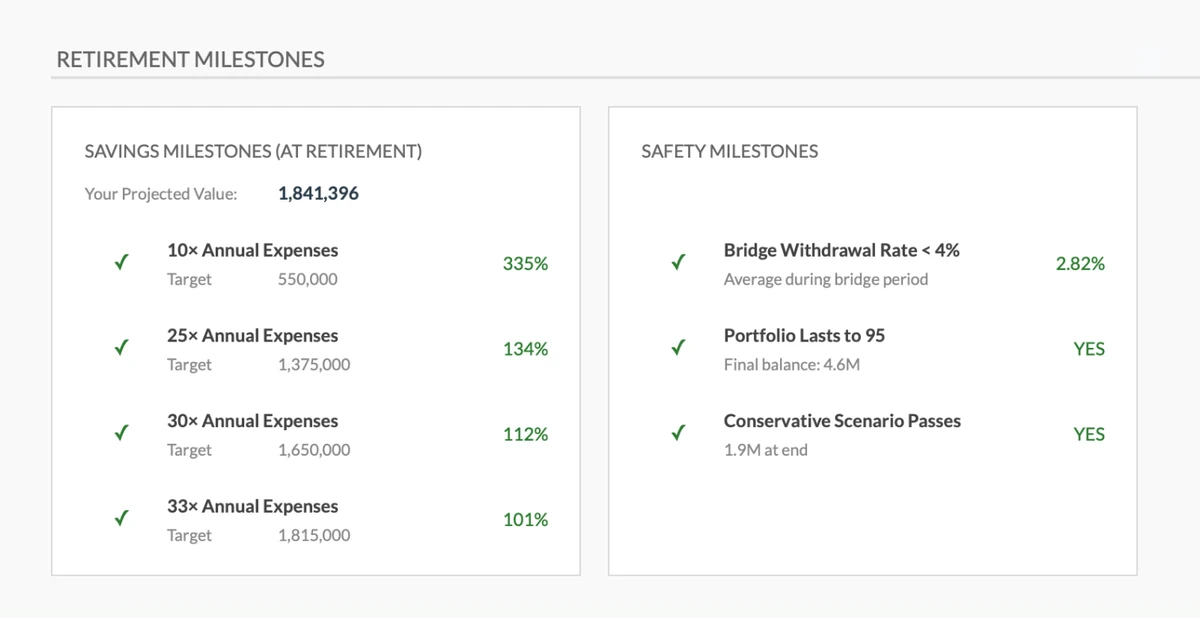

Track Your Progress Toward Retirement

See how your savings stack up against common retirement milestones - 10x, 25x, 30x annual expenses. Safety milestones show if your withdrawal rate is sustainable and your plan passes stress tests.

- Savings milestones (10x-33x)

- Safety milestone checks

- Progress percentages

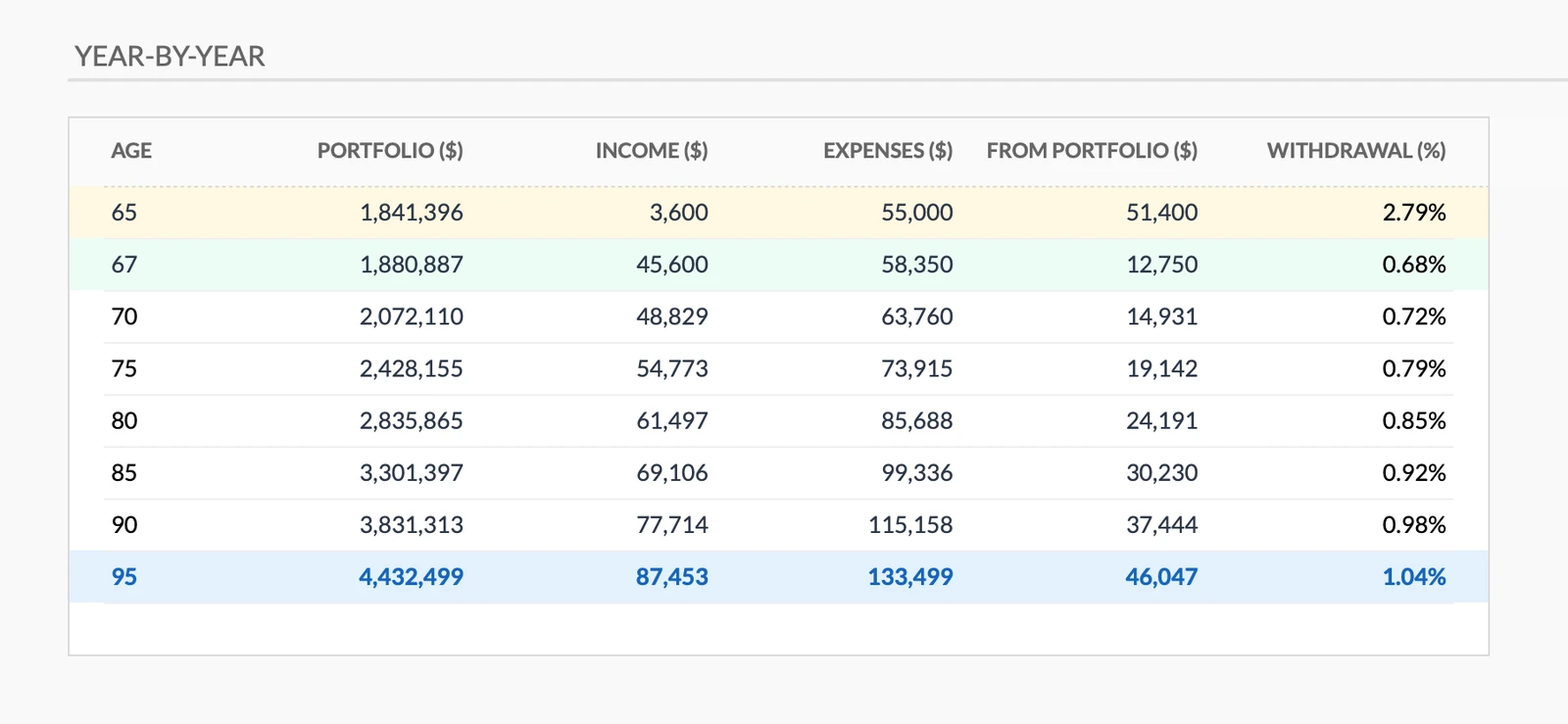

See Your Retirement in 5-Year Intervals

A detailed table showing your portfolio value, income, expenses, and withdrawal rate in 5-year intervals from retirement through life expectancy. Watch how the numbers change over time.

- Portfolio balance by age

- Income and expense tracking

- Withdrawal rate tracking

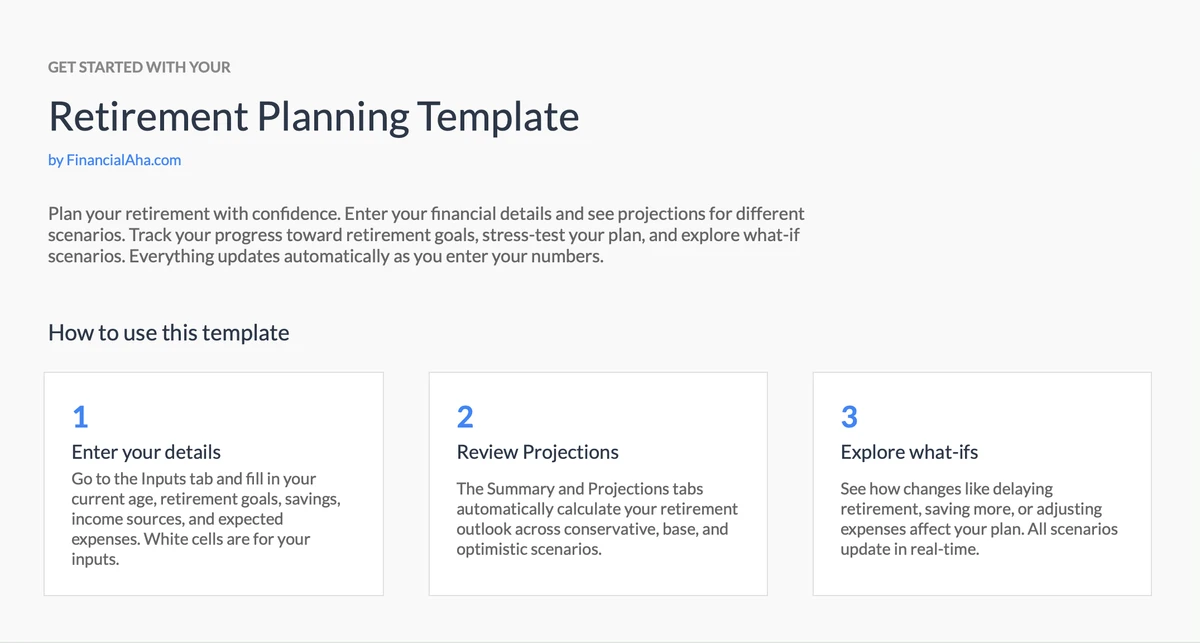

Clear Instructions Included

Step-by-step setup guide walks you through entering your information, understanding the projections, and customizing the template. Start planning in minutes.

- Visual walkthrough of each section

- Examples for common scenarios

- Tips for accurate projections

Customizable & Flexible

Customize the template to match your unique retirement planning needs and financial situation.

- Adjust return assumptions

- Set your target retirement age

- Include pension and other income

Ready to take control of your finances?

Simple 4-Step Process

How It Works

Download & Access

Get instant access to the template via Google Sheets. One-time purchase, lifetime access to plan your retirement.

Enter Your Details

Input your age, savings, expected pension, and retirement expenses. The Inputs tab guides you through each field.

Review Projections

See your retirement timeline across three scenarios - conservative, base case, and optimistic. Check if your plan passes all safety checks.

Explore What-Ifs

Test how changes affect your plan. What if you retire earlier? Save more? Face a market crash? See the impact instantly.

Customer Reviews

What Our Customers Say

"If I get half as good at handling my finances as you are at customer service, this'll be the best $26 I've spent lately."

"Great tool! Simplifies financial planning without the hassle of complex spreadsheets."

"I recently purchased your super convenient spreadsheet, it really helps me!"

"They're great and super intuitive. Thank you!"

Built for Results

Why This Template Works

Retirement Ready

Know exactly where you stand financially for retirement.

Easy to Use

Enter numbers in highlighted cells. Pre-built formulas do the calculations.

Google Sheets Based

Access anywhere, on any device. Cloud-based.

Always Improving

Free updates included at no extra cost.

Privacy First

Your data stays private. We never see it.

Lifetime Access

One-time purchase. Own it forever.

Got Questions?

Frequently Asked Questions

Is this template free to use?

This template is not free, but it is available for a one-time purchase. This purchase gives you lifetime access to the template and all future updates.

What do you mean by lifetime access?

Lifetime access means that you will have access to this template for as long as you need it. You will not be required to pay any additional fees for continued access to the template or any future updates.

Do I need to sign up to use this template?

You don't need to create an account with us. The template works in Google Sheets, so you'll need a Google account. If you don't have one, you can create one for free at google.com. After you purchase the template, copy it to your Google Drive, and start using.

What are the benefits of using this template?

This template offers a range of benefits, including: Easy-to-use interface, Customizable to suit your needs, Secure and private, Regular updates and improvements, One-time purchase for lifetime access.

Can I get future updates?

Yes, you will receive all future updates to this template at no additional cost. This ensures that you always have access to the latest features and improvements.

Do you offer any discounts?

At this time, we do not offer any discounts on this template. However, the template is available for a one-time purchase, which provides lifetime access and free updates.

Do you have any access to my financial data?

No, we do not have access to your financial data when you use this template. The template is designed to be used in your own Google Sheets account, ensuring that your financial information remains private and secure.

Is this template financial advice?

Our templates are not financial advice. They are tools designed to help you manage your personal finances more effectively. If you need personalized financial advice, consider consulting with a financial advisor or accountant.

Can I make my own changes and customize this template?

Yes, you can make your own changes and customize this template to suit your needs. The template is designed to be flexible and adaptable, allowing you to add or remove sections, change formulas, and adjust formatting as needed.

Do you offer technical support?

This is a self-service product, and we do not offer technical support. However, if you encounter any issues or have any questions about the template, please contact our team for assistance. Because everyone's financial situation is unique, consider consulting with a financial advisor or accountant if you need personalized financial advice.

Do you offer refunds?

Yes. We offer a 14-day money back guarantee on all paid products. If you're not satisfied for any reason, contact us within 14 days of purchase for a full refund.

Can't find the answer you're looking for? Contact our team

Highlights:

Ready to Plan Your Retirement?

Get instant access to the Retirement Financial Planning & Projections template and start building your path to a secure retirement.