There’s a lot of personal finance content telling you to save more, invest earlier, cut the lattes. Most of it is opinion.

We wanted something different - actual data you can explore. So we built a set of free tools using publicly available government sources: Bureau of Economic Analysis, Federal Reserve, World Bank, and College Scorecard.

No opinions on what you should do with your money. Just numbers, interactive charts, and transparent methodology.

FIRE Number by City - Retirement Costs Across 380+ U.S. Metros

How much do you actually need to retire early? It depends heavily on where you live.

We used BEA Regional Price Parities to calculate FIRE numbers for every major U.S. metro area. The results show a $1.4 million gap between the cheapest and most expensive cities - from around $950K in Pine Bluff, Arkansas to over $2.3M in San Jose.

The tool includes:

- Sortable data table with all 380+ metros

- Interactive U.S. map visualization

- Custom calculator for your spending level

- Lean, regular, and fat FIRE targets

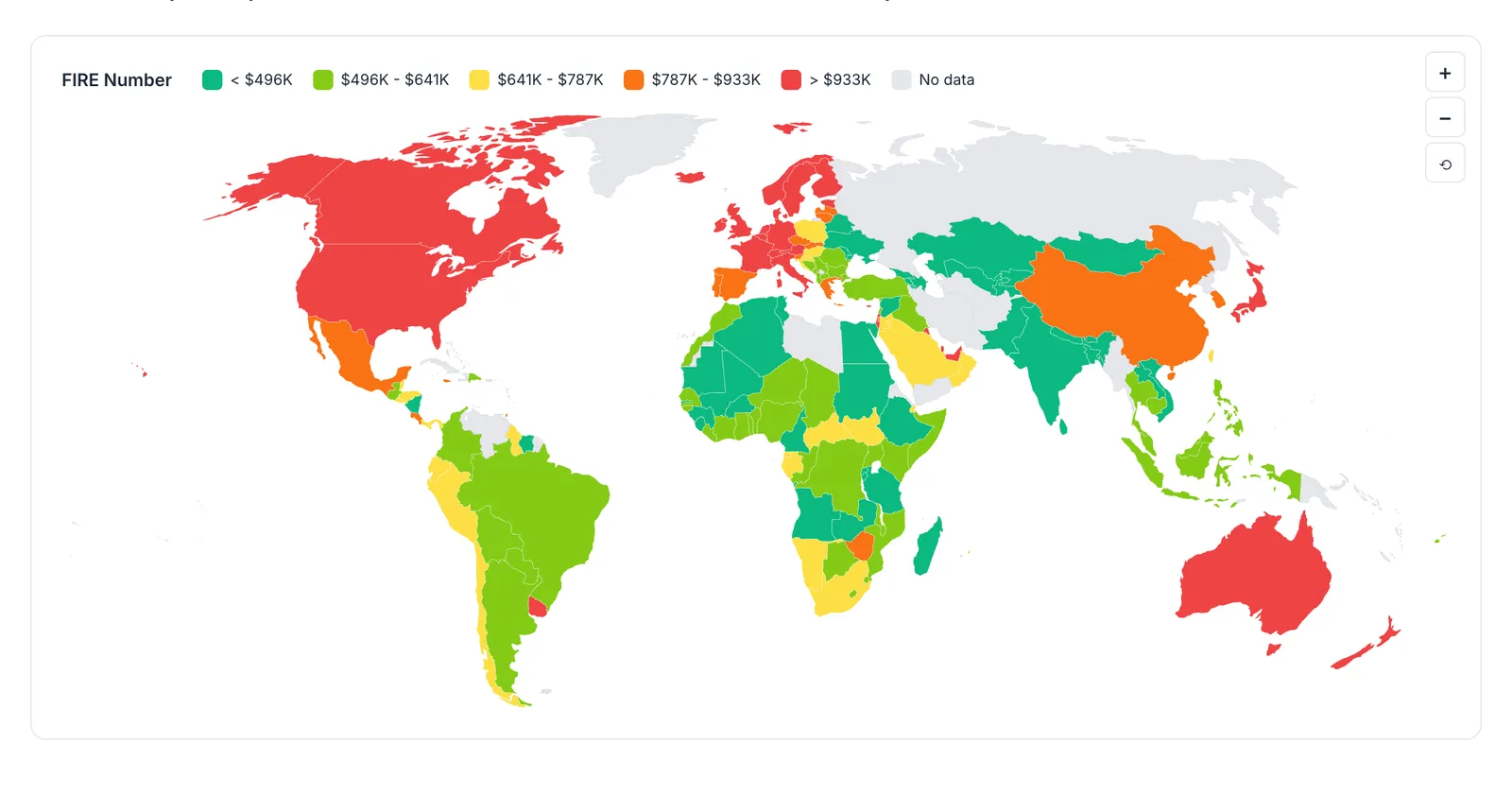

FIRE Number by Country - Global Retirement Cost Comparison

Same question, worldwide scope. What does financial independence cost in Portugal vs. Thailand vs. Switzerland?

Using World Bank Price Level Index data, we calculated FIRE numbers for 170+ countries. For anyone considering geo-arbitrage - earning in a high-income country, retiring somewhere cheaper - the differences are significant.

We also included context on what these numbers don’t capture: visa requirements, healthcare systems, tax implications. A low cost of living doesn’t help if you can’t legally stay there.

Explore FIRE Number by Country →

Net Worth by Generation - Boomers vs. Gen X vs. Millennials

The “Millennials are broke” vs. “Millennials are doing fine” debate rarely uses actual data. We pulled Federal Reserve Survey of Consumer Finances results from 1989 to 2022 and compared generations at the same ages.

The generational wealth analysis shows:

- Median net worth at ages 35-44 for each generation

- How the 2008 financial crisis affected different age groups

- Recent recovery trends that don’t get much attention

- Interactive calculator to compare your net worth to historical data

Explore Net Worth by Generation →

Student Loan Burden by Major - College Degree ROI Data

Which college degrees pay off fastest? Not in vague terms - in actual debt-to-earnings ratios.

Using College Scorecard data, we calculated how many months of post-graduation earnings it takes to pay off median student debt for 188 majors.

The range is dramatic:

- Computer Engineering: ~3 months of earnings

- Drama and Theater Arts: ~18 months of earnings

The gap is mostly about starting salaries, not debt levels. Most majors have similar loan amounts ($20K-$30K median), but first-year earnings vary by 4x across fields.

Explore Student Loan Burden by Major →

Why We Built These Tools

The BEA publishes regional price indices every year. The Fed runs detailed wealth surveys every three years. The Department of Education tracks student outcomes by major. It’s all public data.

But unless you’re a researcher or a journalist on deadline, you’re probably not downloading CSVs from data.gov and running your own analysis.

We figured it was worth making accessible:

- Interactive tables you can sort, filter, and search

- Maps and visualizations that aren’t ugly

- Calculators where you can plug in your own numbers

- Methodology pages explaining exactly how we calculated everything

What This Data Is (and Isn’t)

These tools provide context, not recommendations.

The student loan analysis doesn’t say “don’t major in drama.” The FIRE maps don’t say “move to Arkansas.” That’s not the point.

Knowing that the median 35-year-old has a certain net worth doesn’t tell you what to do. But it’s a reference point. Same with knowing your city’s FIRE number is 40% above the national median, or that your intended major has a 0.8 debt burden ratio.

What you do with that information is up to you.

We’re adding more analyses as interesting datasets become available.