Two budgeting methods come up repeatedly in personal finance discussions: the 50/30/20 rule and zero-based budgeting. Both have devoted followers. Both work - for certain people, in certain situations.

The difference isn’t which one is “better.” It’s which one matches how you think about money and how much time you want to spend managing it.

The 50/30/20 Rule: Budgeting by Percentages

The 50/30/20 rule divides after-tax income into three buckets:

- 50% for needs - Housing, utilities, groceries, insurance, minimum debt payments, transportation to work

- 30% for wants - Dining out, entertainment, hobbies, subscriptions, travel, non-essential shopping

- 20% for savings - Emergency fund, retirement contributions, extra debt payments, investment accounts

The appeal is simplicity. Instead of tracking 47 categories, you track three. Instead of agonizing over whether to allocate $127 or $143 to entertainment, you check whether your “wants” spending stays under 30%.

Where 50/30/20 Works Well

Variable income. Freelancers, commission-based workers, and seasonal employees often find percentage-based budgeting more practical. When income fluctuates, fixed dollar amounts become meaningless. Percentages scale automatically.

High earners. Someone earning $150,000 doesn’t need to track every dollar the way someone earning $35,000 might. The 50/30/20 framework provides guardrails without requiring obsessive categorization.

Budgeting beginners. Three categories are easier to maintain than thirty. For people who have never stuck with a budget, starting simple increases the chance of building the habit.

People who dislike detail work. Some people find granular expense tracking draining. If the alternative to 50/30/20 is no budget at all, the simpler method wins.

Where 50/30/20 Falls Short

High-cost-of-living areas. In cities like San Francisco, New York, or London, housing alone can exceed 50% of income. The framework assumes a cost structure that doesn’t exist everywhere.

Debt payoff situations. Someone aggressively paying down student loans or credit card debt may need to allocate 40% or more to debt - far exceeding the 20% savings bucket.

Low incomes. When income barely covers necessities, the “30% for wants” category may be unrealistic. The framework works better above certain income thresholds.

People who need accountability. The broad categories can hide overspending. “Wants” is vague enough to justify almost anything.

Zero-Based Budgeting: Every Dollar Has a Job

Zero-based budgeting takes the opposite approach. Instead of broad percentages, every dollar of income gets assigned to a specific category before the month begins. Income minus planned expenses equals zero - hence the name.

If you earn $4,500 after taxes, you might allocate $1,200 to rent, $400 to groceries, $150 to utilities, $300 to car payment, and so on until every dollar is accounted for. Nothing is left unassigned.

Where Zero-Based Budgeting Works Well

Tight budgets. When there’s no margin for error, knowing exactly where every dollar goes matters. Zero-based budgeting forces awareness that looser systems don’t.

Debt payoff focus. Assigning specific amounts to debt payments - rather than hoping something is left over - accelerates payoff timelines.

Impulse spending issues. The discipline of pre-assigning money makes unplanned purchases more visible. There’s no “miscellaneous” bucket to absorb random spending.

Detail-oriented people. Some people genuinely enjoy tracking and optimizing. Zero-based budgeting rewards that tendency.

Couples with different spending styles. When partners need to agree on money allocation, explicit dollar amounts reduce ambiguity. “We budgeted $200 for dining out” is clearer than “we’re in the ‘wants’ category.”

Where Zero-Based Budgeting Falls Short

Time requirements. Creating and maintaining a detailed budget takes hours per month. For some people, this time investment isn’t sustainable.

Variable income. When you don’t know what you’ll earn, assigning every dollar becomes guesswork. Percentages handle variability better.

Lifestyle changes. Major transitions - new job, new city, new family situation - require rebuilding the entire budget. The detailed structure becomes a liability during unstable periods.

Perfectionism traps. Some people abandon zero-based budgeting when they can’t make the numbers perfect. A “good enough” approach often outlasts a “perfect” one.

Comparing the Two Methods

| Factor | 50/30/20 | Zero-Based |

|---|---|---|

| Time required | Low - monthly check-in | High - ongoing tracking |

| Flexibility | High - broad categories | Low - specific allocations |

| Accountability | Moderate | High |

| Variable income | Handles well | Struggles |

| Debt payoff | Basic support | Strong support |

| Learning curve | Minimal | Moderate |

| Maintenance | Easy | Demanding |

Neither method is inherently superior. The best budget is one you’ll actually use.

A Hybrid Approach

Many people end up combining elements of both methods. One common pattern:

- Use 50/30/20 as a high-level framework to check overall allocation

- Apply zero-based thinking within the “needs” category where fixed expenses dominate

- Keep “wants” as a flexible bucket without detailed subcategories

- Track savings goals specifically within the 20%

This captures the structure of zero-based budgeting where it matters most - fixed expenses and savings - while preserving flexibility elsewhere.

Questions to Help You Choose

How much time are you willing to spend on budgeting? If the answer is “as little as possible,” lean toward 50/30/20. If you don’t mind regular check-ins and enjoy optimization, zero-based budgeting rewards the effort.

Is your income stable or variable? Stable income suits zero-based budgeting. Variable income works better with percentages.

Are you paying down significant debt? Aggressive debt payoff benefits from the specificity of zero-based budgeting. The 50/30/20 approach treats debt payoff the same as other savings.

Have you successfully maintained a budget before? If previous budgets failed due to complexity, start simpler with 50/30/20. You can always add detail later.

Do you need accountability or flexibility? Zero-based budgeting creates accountability through specificity. 50/30/20 provides flexibility through broad categories. Most people lean toward one or the other.

Getting Started

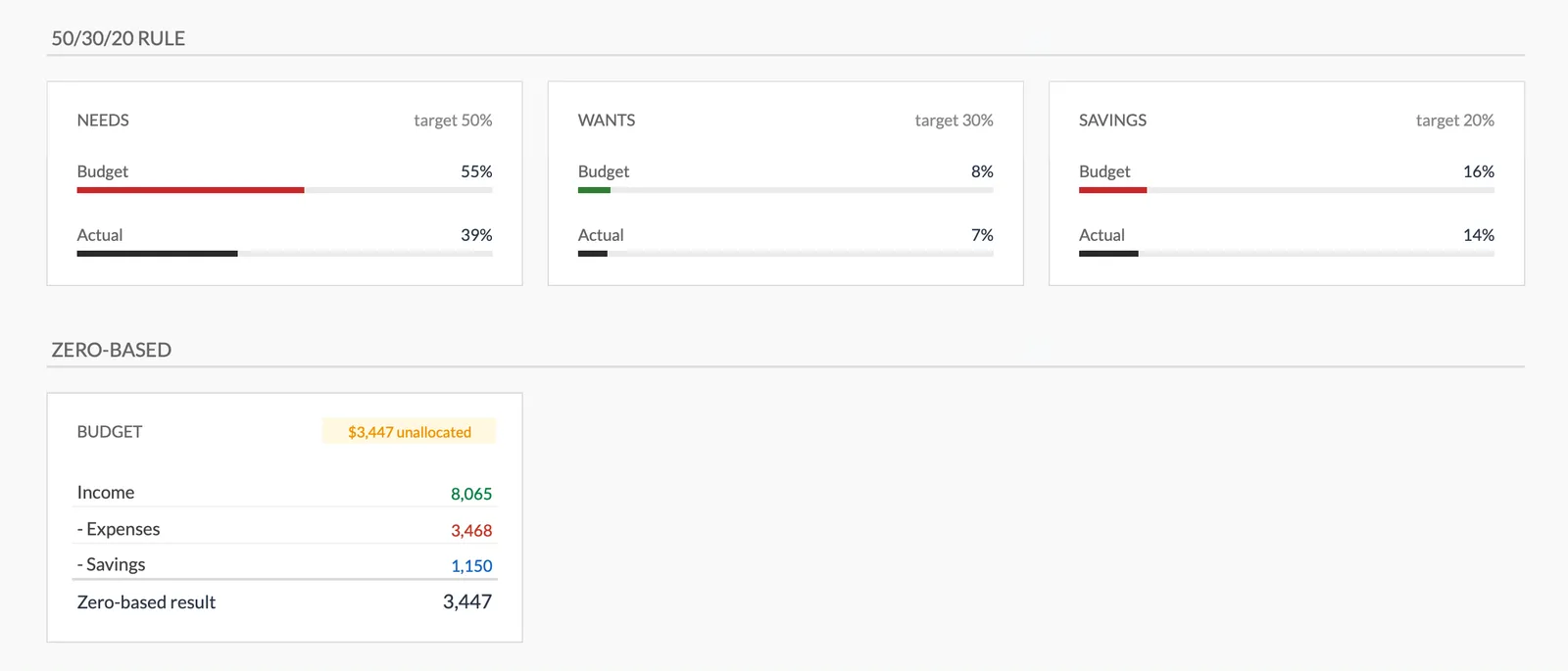

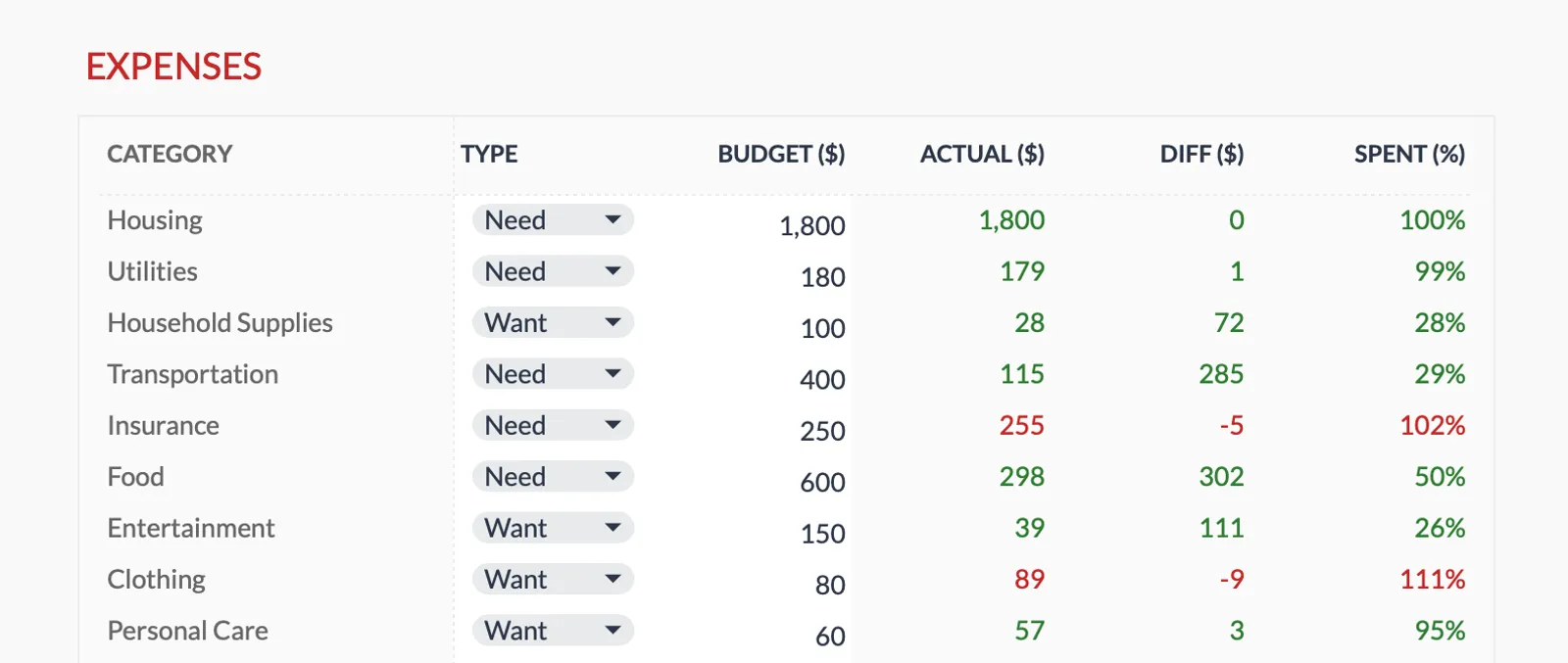

Both methods work in spreadsheets. The Monthly Budget Template supports both approaches - it includes 50/30/20 tracking that automatically categorizes your spending, while also allowing detailed budget targets per category for zero-based planning.

The template calculates your needs/wants/savings percentages automatically, so you can see at a glance whether your overall allocation matches the 50/30/20 guideline. At the same time, you can set specific dollar amounts for each expense category and track actual spending against those targets.

For people who want to start with pure expense tracking before committing to either method, the Monthly Expense Tracker provides a simpler starting point. Both templates use compatible categories, so you can graduate from tracking to budgeting without starting over.

The Method Matters Less Than the Habit

Debates about 50/30/20 versus zero-based budgeting can obscure the main point: any systematic approach to tracking money beats no system at all.

Pick a method that seems reasonable given your situation. Try it for two or three months. If it’s working, keep going. If it’s not, adjust. The goal isn’t to find the theoretically optimal budgeting method - it’s to build the habit of paying attention to where money goes and whether that matches your priorities.

Most people who successfully budget for years have modified whatever method they started with. The framework is a starting point, not a destination.