I’m happy to announce the Annual Tax Planner - a template we’ve been working on for months.

This one came from personal frustration. Every year, around February, we’d find ourselves digging through emails looking for 1099s, trying to remember which doctor visits were deductible, and wondering if we’d logged that freelance project from the spring. The information existed somewhere, just never in one place.

So we built a spreadsheet to keep it all together.

What’s in the template

The planner tracks four things:

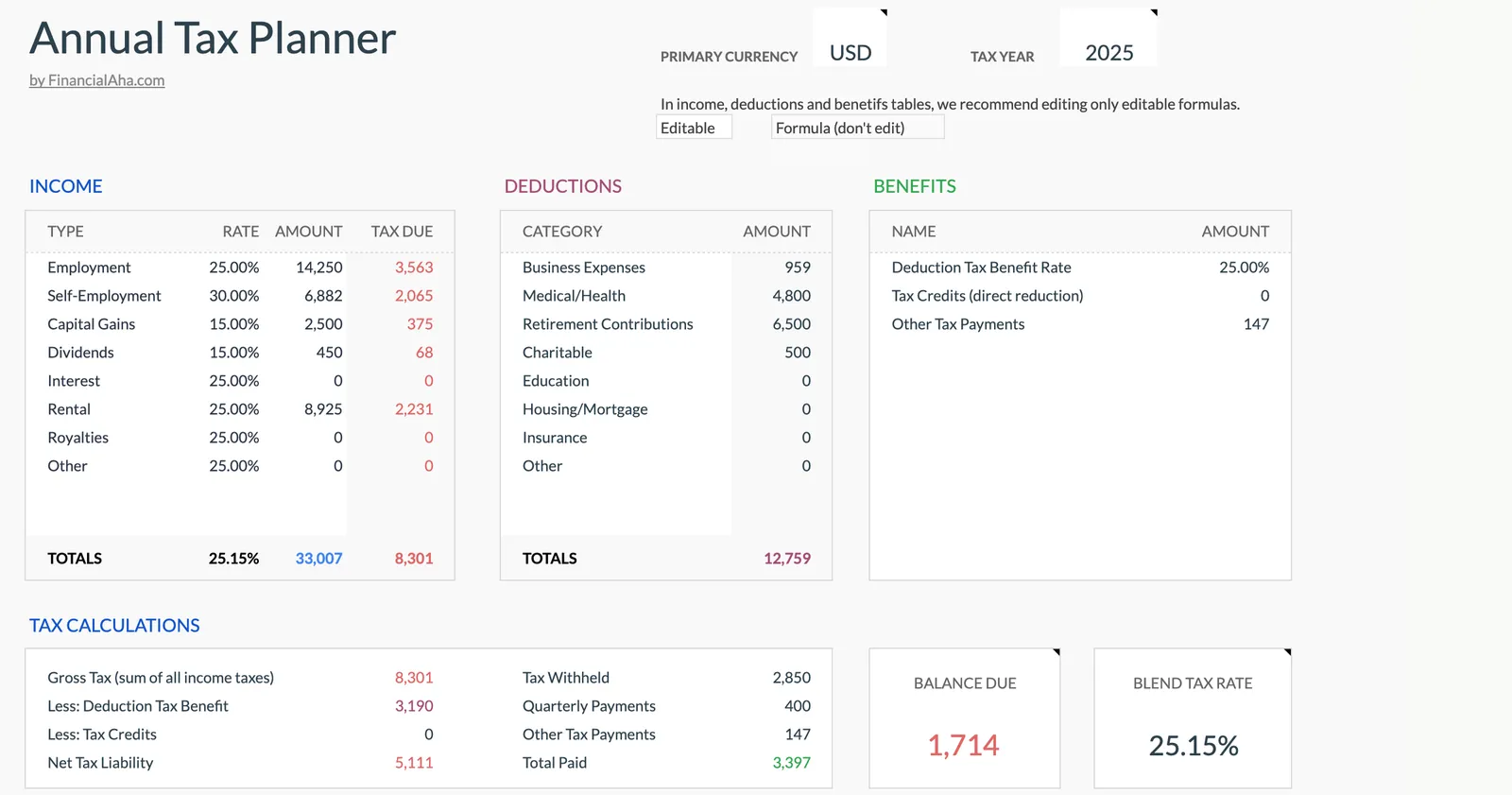

Income from all sources. Employment, freelance work, investments, rental income, royalties. For each entry you log the date, amount, source, and any tax that was already withheld. There’s also multi-currency support if you have foreign income - you can record exchange rates and see everything converted.

Deductions by category. Business expenses, medical costs, retirement contributions, charitable giving, education - log them as they happen instead of trying to reconstruct a year’s worth later. Each entry has room for notes so you remember what it was for.

Quarterly estimated payments. The template tracks all four quarters with due dates, what you’ve paid, and what’s outstanding. Useful if you’re self-employed or have income that doesn’t have withholding.

A document checklist. Check off W-2s, 1099s, and statements as they arrive. Come filing time, you’ll know exactly what you have and what’s still missing.

The point of year-round tracking

Nobody wants to think about taxes in July. But the alternative is that February scramble - pulling bank statements, searching email, trying to remember expenses from 10 months ago.

Logging things as they happen takes a few minutes. Reconstructing a year takes hours. And you’ll miss things.

What this doesn’t do

The template organizes your tax information. It doesn’t calculate what you actually owe - that depends on too many variables. Use it alongside tax software, or bring the organized data to your accountant. Either way, you’ll show up prepared instead of scattered.

And like everything we build, it runs entirely in your own Google Sheets or Excel. We don’t see your data.

Pricing

The Annual Tax Planner is $29 right now - a launch price we’ll raise later. One purchase, keep it forever, updates included.

It’s also in the Personal Finance Bundle with the Financial Planning Template and Annual Budgeting Planner if you want the set.