Managing personal finances can be overwhelming, but creating an advanced personal finance tracker in Google Sheets can make budgeting and expense tracking much more efficient and insightful. In this blog post, we’ll walk you through creating a robust and dynamic finance tracker that not only tracks income and expenses but also monitors savings, investments, and financial goals.

Why Use Google Sheets for Personal Finance?

Google Sheets is a powerful, versatile, and free tool that allows you to build custom finance trackers with ease. You can track income, expenses, savings, and investments all in one place. Plus, since it’s cloud-based, you can access your tracker from anywhere and share it with your partner or family members.

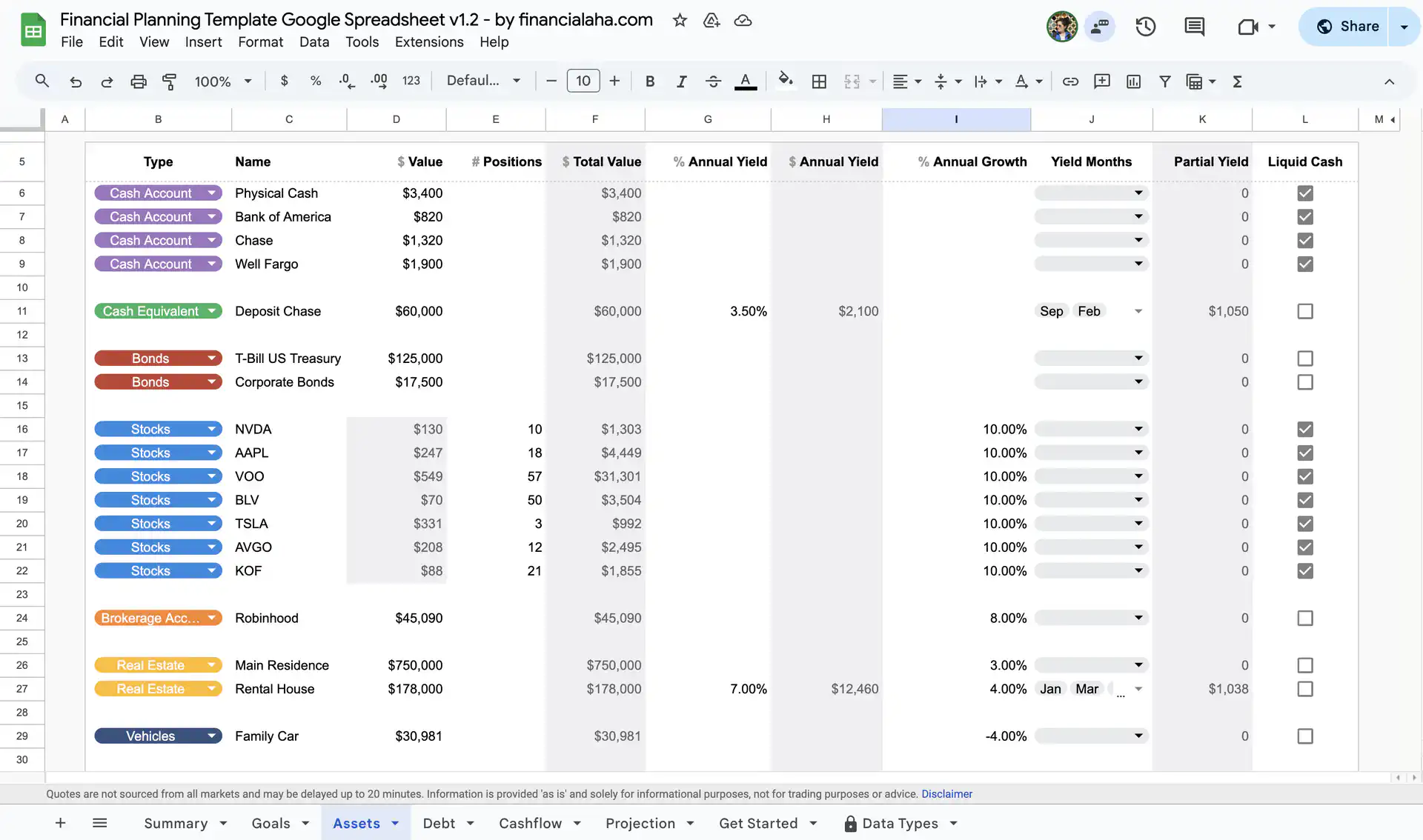

However, creating an advanced tracker from scratch can be time-consuming and challenging. If you want a professional and pre-built solution, consider purchasing a premium personal finance spreadsheet template from Financial Aha . These templates are expertly designed to save you time and provide advanced features out of the box.

Step 1: Set Up Your Spreadsheet with Advanced Structure

- Open Google Sheets and create a new spreadsheet.

- Rename the spreadsheet to something like “Advanced Personal Finance Tracker”.

- Create separate tabs for each category:

- Dashboard: A visual summary of your finances.

- Income: Track earnings from various sources.

- Expenses: Categorize and track spending.

- Savings: Monitor your progress towards savings goals.

- Investments: Keep track of your investment portfolio.

- Budget Planning: Set monthly or yearly budgets.

- Debt Tracker: Monitor outstanding debts and repayments.

Step 2: Implement Dynamic Income Tracking

- In the “Income” tab, create the following columns:

- Date

- Source (e.g., Salary, Freelance, Investments)

- Description

- Amount

- Category (e.g., Fixed, Variable)

- Use advanced formulas to analyze trends, such as calculating the average monthly income:

=AVERAGEIF(A2:A100, "<>", D2:D100)

- Implement pivot tables to break down income by source or month.

Step 3: Create a Comprehensive Expense Tracker

- In the “Expenses” tab, include the following columns:

- Date

- Category (e.g., Housing, Food, Entertainment)

- Subcategory (e.g., Rent, Groceries, Dining Out)

- Description

- Payment Method (e.g., Credit Card, Cash)

- Amount

- Recurring? (Yes/No)

- Leverage the

SUMIFSfunction to calculate expenses by category and payment method:=SUMIFS(E2:E100, B2:B100, "Housing", D2:D100, "Credit Card")

- Use conditional formatting to highlight high spending or overdue payments.

Step 4: Track Savings and Investment Growth

- In the “Savings” tab, list the following columns:

- Date

- Account Name

- Amount Deposited

- Total Balance

- Interest Rate

- Use formulas to calculate compound interest and project savings growth:

=A1*(1 + R)^N(whereA1is the principal,Ris the interest rate, andNis the number of periods)

- In the “Investments” tab, track:

- Investment Type (e.g., Stocks, Bonds)

- Buy Price, Sell Price, Quantity

- Current Value

- Gain/Loss Calculation

Step 5: Create an Interactive Dashboard

- Use charts and graphs to visualize your data:

- Bar charts for monthly income and expenses.

- Pie charts to display the distribution of expenses.

- Line charts to track investment growth over time.

- Add interactive elements, such as drop-down menus and slicers, to filter data easily.

Automate with Scripts and Add-ons

- Use Google Apps Script to automate data entry and analysis.

- Integrate add-ons like Money in Excel for additional functionality.

Why Buy a Professional Template Instead?

Building an advanced personal finance tracker from scratch can be tedious and error-prone. Save time and get access to a professional, pre-built solution with dynamic features by purchasing a premium template from Financial Aha . These templates are ready to use, highly customizable, and come with comprehensive instructions.

Final Thoughts

Taking control of your finances is crucial, and using a well-structured finance tracker in Google Sheets can help you achieve financial stability. Whether you build one from scratch or opt for a professional template, consistency in tracking and analysis is key. Get started today and make informed financial decisions effortlessly!